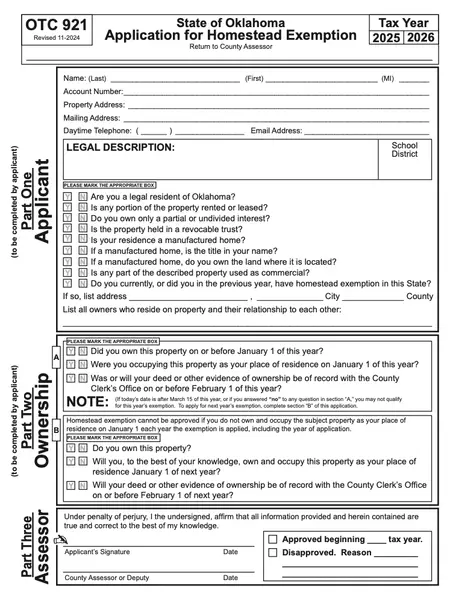

Get Your Oklahoma Homestead Exemption Form

The Homestead Exemption in Oklahoma provides a property tax reduction. This exemption helps lower property taxes for qualifying residents.

Requirements: To qualify, you must: 1. Own and reside in the home as your primary residence as of January 1st of the tax year. 2. Not already be claiming a homestead exemption on another property. 3. File an application with the County Assessor’s Office in the county where the property is located.

Timelines: The application must be submitted on or before March 15th of the year in which the exemption is claimed. Once granted, the exemption remains in effect unless ownership changes or the homeowner moves.

How to File: 1. Download a Homestead Exemption Application here. 2. Complete the form with your personal and property details.

Provide proof of residency, such as a valid Oklahoma driver’s license or utility bill. 3. Submit the completed application to the County Assessor’s Office in person or by mail before the deadline.

For more details, contact your local County Assessor’s Office.

click here to download the file manually.